Private equity sector suffers from a lack of exits

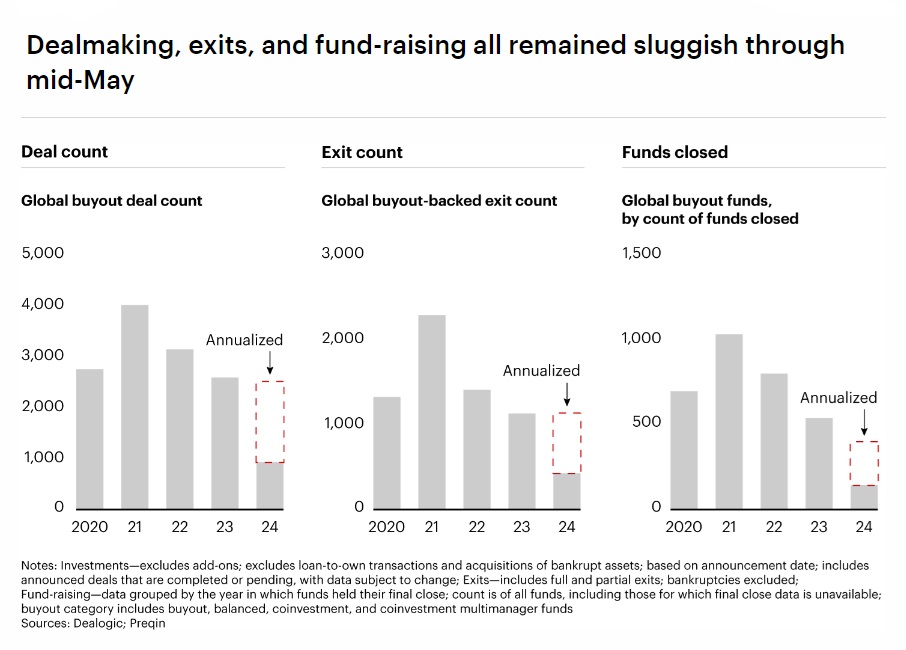

After a significant decline in the number of deals over the past two years, the private equity market appears to have stabilized by early 2024.

This is evident from the new mid-year Private Equity report from management consultancy Bain & Company.

The sector’s precipitous decline in deal numbers over the past two years has leveled off in early 2024, and buyout funds worldwide are now on track to end the year essentially flat versus 2023’s total, according to Bain & Company .

So a stabilization, but nothing that, according to the consultancy, resembles a ‘normal’ pace of investments and exits.

When will deal activity increase?

A survey of more than 1,400 market participants shows that about 30 percent expect deal activity to increase only in the fourth quarter, while nearly 40 percent predict this won’t happen until 2025 or later.

The current macroeconomic environment, characterized by high interest rates and geopolitical uncertainty, poses a major challenge for closing transactions.

North America is seeing an increase in deal value despite a decline in the number of deals, while Europe and Asia are experiencing sharp declines due to economic sluggishness.

The deal value for 2024 is estimated at around the same level as in 2018. This despite a significant increase in available resources (dry powder) which is currently 1.5 times higher than then.

Few exits

Although a free fall in exits has been avoided, activity remains at a low level. Many funds are struggling to raise new capital as Limited Partners (LPs) wait for more distributions.

The overall slowdown in exits is making life increasingly uncomfortable for GPs in several ways. First, it has a measurable impact on the ability of funds to attract new capital.

Another negative consequence is the sharp increase in the number of active portfolio companies in recent years – a result of dealmaking happening faster than exits and funds holding assets longer. An analysis of the fund series at 25 of the largest buyout firms shows that the number of portfolio companies they manage has doubled over the past decade, giving sponsors twice as many claims on their limited resources and bandwidth

Despite some relief from rising stock markets, the fundraising environment remains challenging, with many funds struggling to meet their targets.

The full report provides more information about the trends and their implications for the future of private equity.