‘Economic rationale for investing in green infrastructure and technology is watertight’

In an interview with the Dutch M&A platform MenA.nl, Jacqueline van den Ende and Liza Rubinstein Malamud, co-founders of Carbon Equity, provide a hopeful outlook on combating climate change through innovation and private equity. Despite challenges like reduced corporate climate ambitions and political resistance, they see a clear path forward driven by climate tech entrepreneurs and strategic investments.

Founded three years ago in Amsterdam, Carbon Equity focuses on leveraging capital to fight climate change. They have already raised 250 million euros for specialized climate tech funds and plan to invest a billion euros over the next three years. Their goal is to become Europe’s leading Climate Impact Investment Platform. Besides the Netherlands, they are also active in Belgium and Germany.

Van den Ende and Rubinstein Malamud emphasize the economic rationale behind climate policies, bolstered by legislation like the US Inflation Reduction Act, an American law that, among other things, stimulates domestic investments in green energy. For both Democrats and Republicans, the climate transition is the economically rational path to take.

“The climate transition is nothing less than the fourth industrial revolution”, Van den Ende explains. “We must completely transition from fossil energy to green energy within a few decades, which offers enormous opportunities. If Europe or America do not seize this opportunity, China will. For America, it’s about building a defensive, long-term green industry. This creates jobs and attracts industry. There is a race to the top in terms of geopolitical competition for the green industry. Even with a possible Trump administration, you see that Republican states and companies ultimately benefit from climate policy. But they are concerned with economic rationality, not with a ‘do-good’ mentality. ESG is often seen as an anti-woke identity politics, but the economic rationale for investing in green infrastructure and technology is watertight.”

Don’t bet on the horse, but on the right direction of travel

Liza Rubinstein Malamud explains that Carbon Equity invests in a wide range of climate solutions, covering five sectors: energy and manufacturing, industry, mobility, the built environment and the food system. These sectors are responsible for all emissions. They also invest in carbon management for the capture and removal of CO2. They support both early innovative ideas, such as extracting magnesium from seawater for lighter and stronger materials, as well as growth capital and buyouts, such as synthetic fuels and efficient battery storage.

“There are so many interesting innovations, such as precision fermentation, with which we make animal molecules without animals. This ensures that plant-based cheese and meat taste just as good as the animal variants”, says Rubinstein Malamud.

“There are also many innovations in the field of electricity and cement. We have companies that make CO2-free cement using different methods, such as micro-organisms or electricity. There are tons of good ideas that are worth funding. These innovations will likely have an impact in different places and at different scales.”

Van den Ende says that their strategy is to invest in multiple technologies for the same problems, because they do not yet know which technologies will ultimately be successful. “Don’t bet on the horse, but on the right direction of travel.”

Jacqueline van den Ende emphasizes that many technologies are on the verge of a breakthrough thanks to the ‘technological learning curve’. This curve shows that the costs of technologies drop rapidly as they scale, leading to a flywheel effect of faster adoption. “Solar panels have fallen in price by 96 percent since 1970”, she explains. “Lower costs lead to more demand, more demand leads to greater scale, greater scale leads to even lower costs, and so on. This ensures that technology costs drop much faster than initially expected, resulting in faster adoption. Some technologies are really on the cusp of this point, and we expect these markets to grow extremely fast.”

Towards a positive future

Carbon Equity’s approach involves democratizing private equity, allowing smaller investors to participate in impactful climate tech startups. This strategy is built on rigorous due diligence and a focus on innovations across energy, industry, mobility, construction, and food systems. The founders stress the need for technological solutions to achieve a low-carbon future and highlight the significant role of private capital in driving these innovations.

The transition to net zero within a few decades is an unprecedented task. Yet the mood within the impact investing community is largely optimistic. “This is due to the many interesting innovations and the large number of talented people working on them”, says Van den Ende. “When you see what is happening, it is difficult not to get excited. There is a huge pool of talent in the climate sector. At Carbon Equity we receive hundreds of applications per vacancy, and an incredible number of successful entrepreneurs are currently focusing on climate tech.”

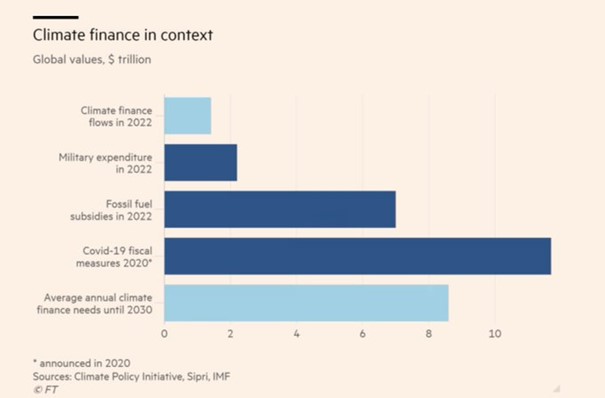

But challenges remain, such as raising insane amounts of capital (see table below) to make the transition possible. And that is exactly what Carbon Equity is here for. “The economic potential and the possibilities for financial profit are evident”, concludes Van den Ende. “It is inspiring to see how problems are solved and value is created, both socially and financially. This gives a lot of energy and an optimistic vision of the future, that mobilizes people and gets them moving.”